GrabPay Malaysia

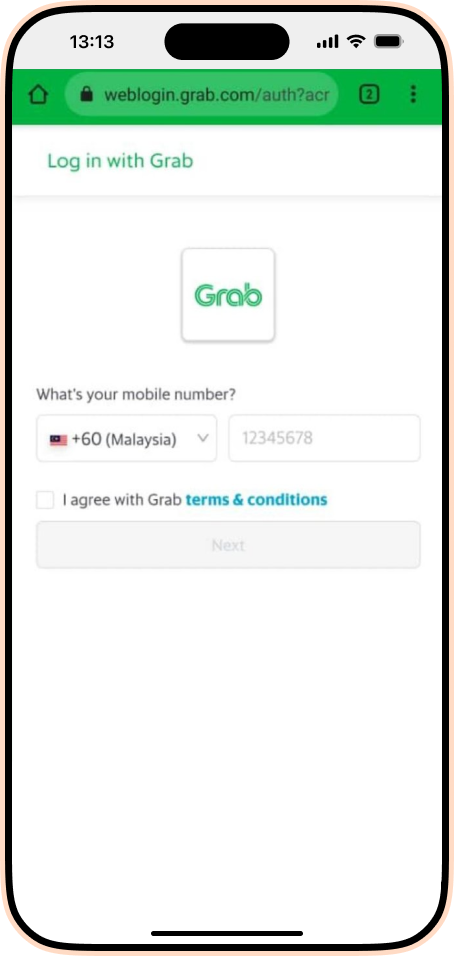

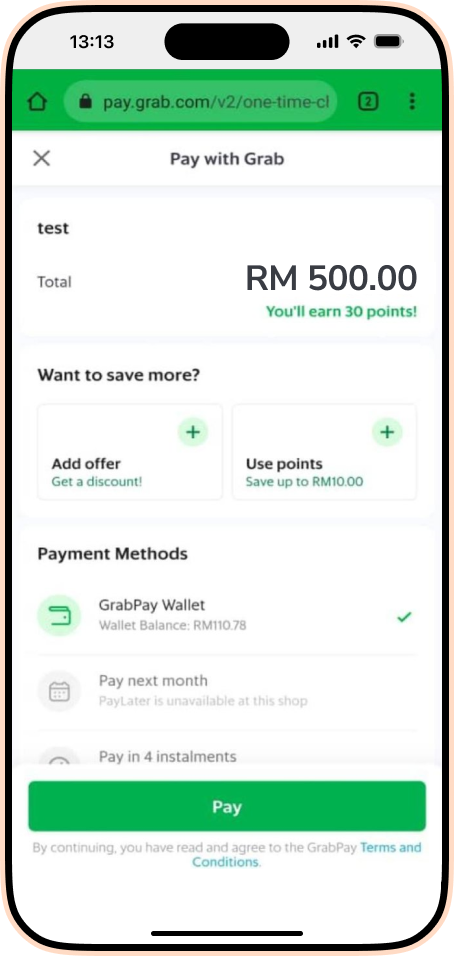

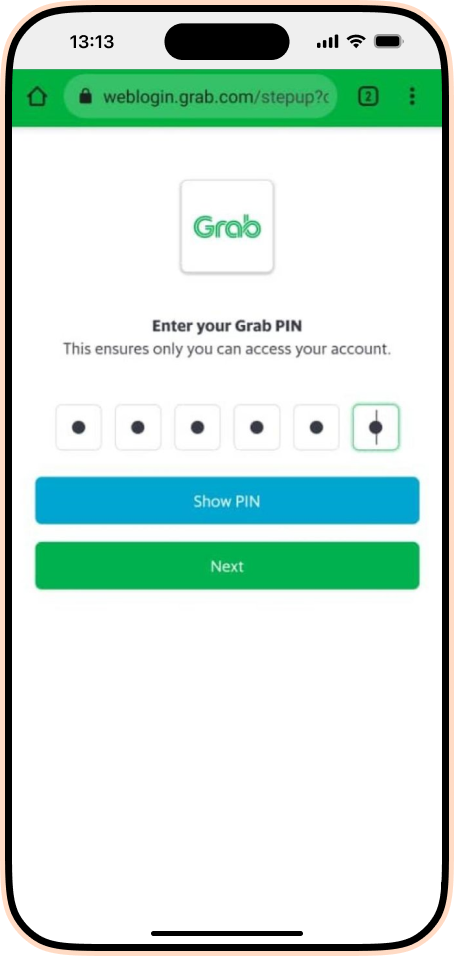

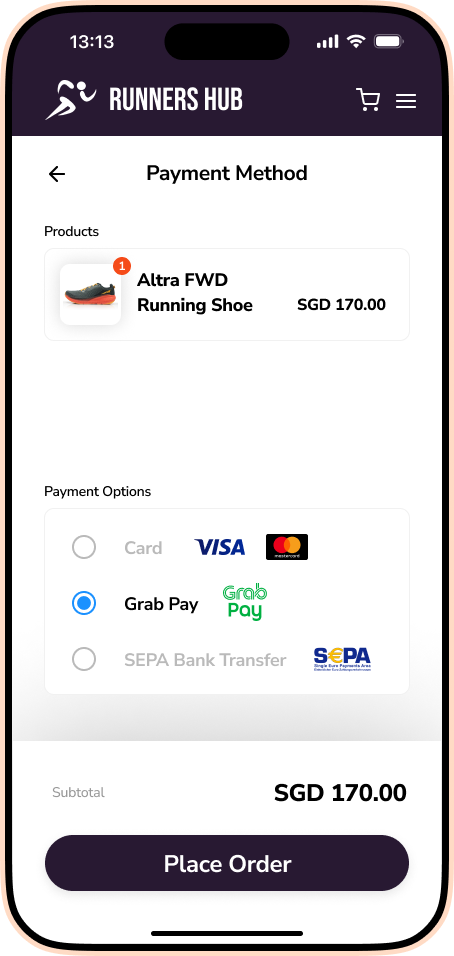

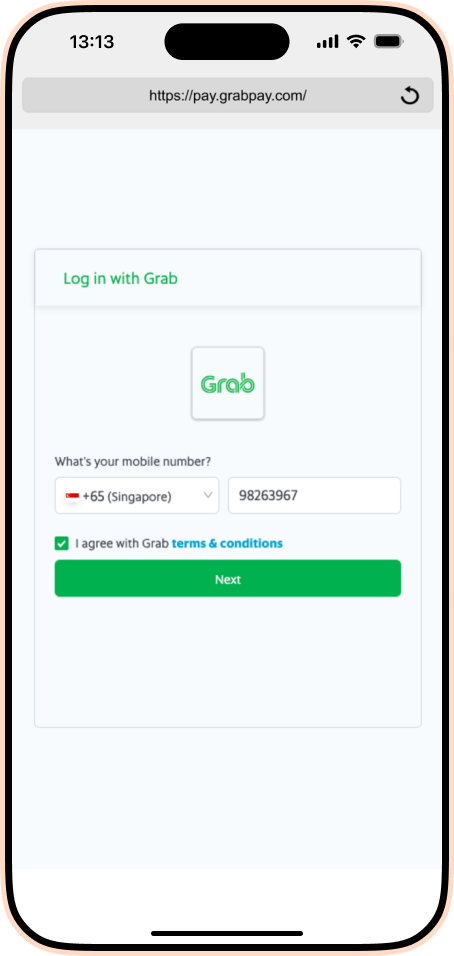

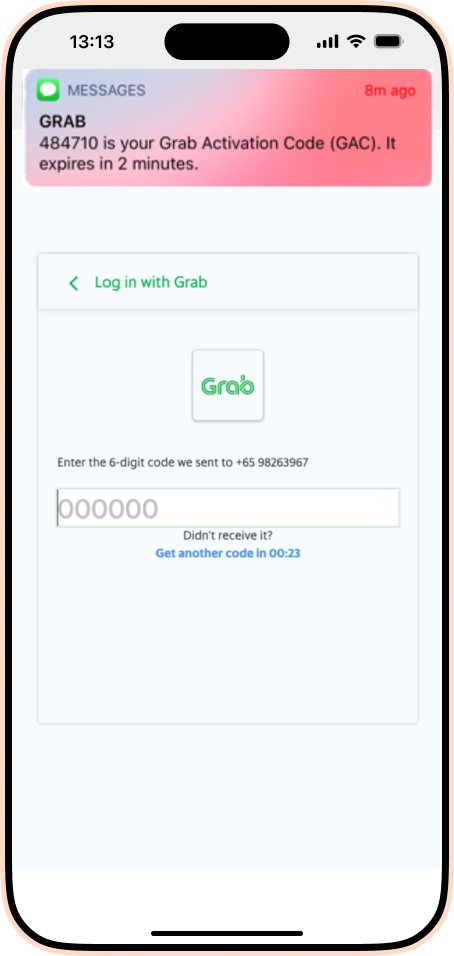

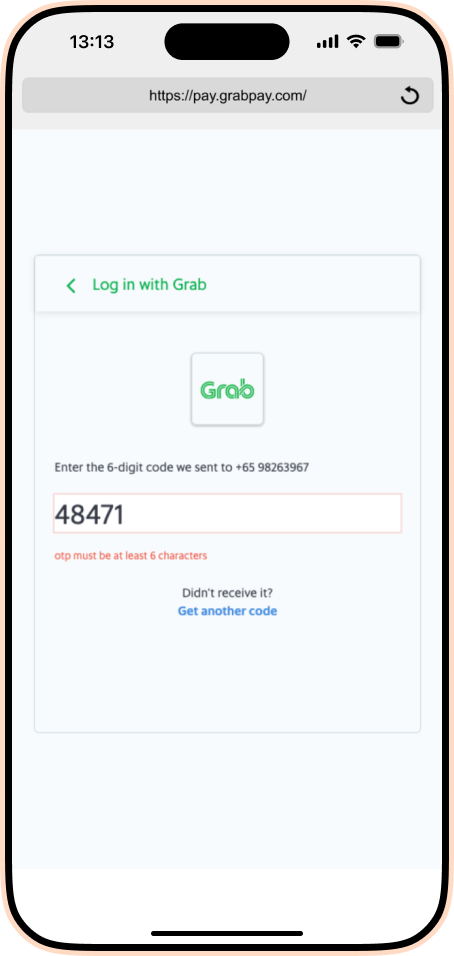

GrabPay is a wallet, and is part of the Grab super app. Grab offers a wide range of virtual products and services, including transport, food delivery, and payments. With over 3,000 merchants across the GrabPay network in Malaysia, consumers can use this wallet in retail stores, food stalls, and e-commerce shops. It’s hard to over-emphasize the potential of GrabPay as a way for cross-border merchants to reach consumers in the fast-growing Southeast Asian market: there are over 17 million Grab users in Malaysia, forecast to reach more than 28 million consumers by 2025 (Statista). Consumers make payments by entering their phone number and one-time verification code.

Want to integrate GrabPay Malaysia onto your platform?

Get in touchGrabPay Singapore

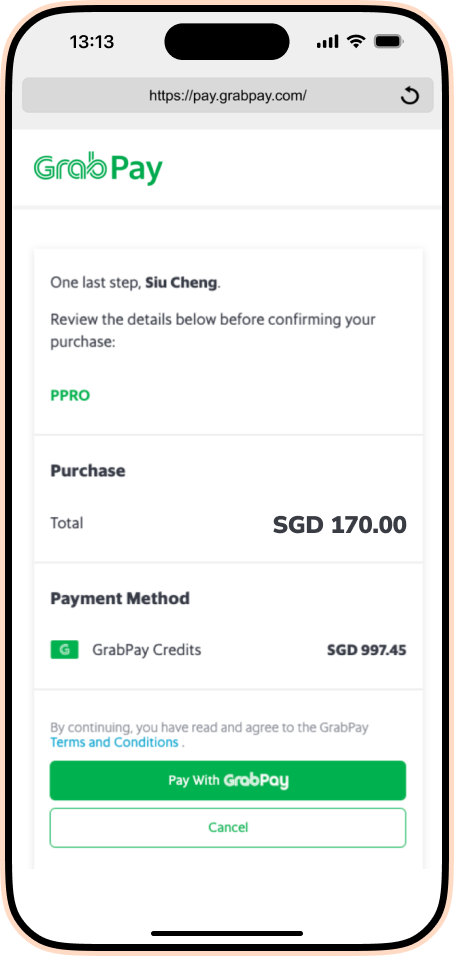

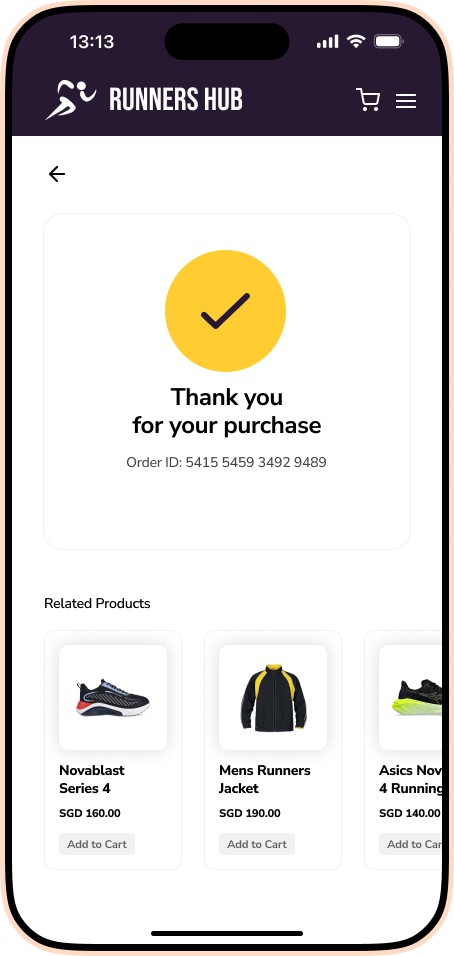

GrabPay is a wallet, which is part of the Grab super app. Grab offers a wide range of virtual products and services, including transport, food delivery, and payments. With over 4,000 merchants across the GrabPay network, consumers can use this wallet in retail stores, food stalls, and e-commerce shops. Online merchants have an opportunity to grow their reach in Singapore with GrabPay: there are over 4 million Grab users in Singapore, and 75% are already using GrabPay daily.

Want to integrate GrabPay Singapore onto your platform?

Get in touchWhy GrabPay Malaysia

Spend-per GrabPay consumer increased by 19% year on year to 2022, due in part to consumers using it to pay for more categories of goods with more merchants (Grab).

In 2020-21, the number of Southeast Asian merchants registered with GrabPay nearly tripled (Grab).

GrabPay is accepted in SG, KH, ID, MY, MM, PH, TH and VN (Grab). By 2030, these countries’ online economies will be worth US$1 trillion (Reuters).

Specifications

Coverage

Currencies

Features

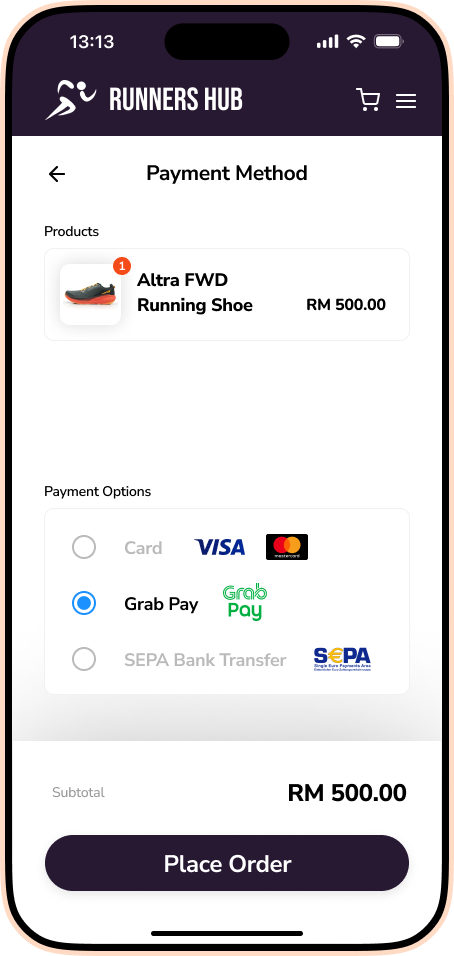

Payment flow

Want to integrate GrabPay Malaysia onto your platform?

Get in touchWhy GrabPay Singapore

In 2022, GrabPay had an estimated 4.9 million users in Singapore (Statista). That’s 96% of the island state’s adult population (PPRO Almanac).

Credit card penetration in Singapore is just 51% (PPRO Almanac) and 2 million Singapore consumers are underbanked – making GrabPay important to any e-commerce strategy.

Accepting online payments with GrabPay is also 20-40% less expensive than with credit cards, making GrabPay a cost-effective payment choice.