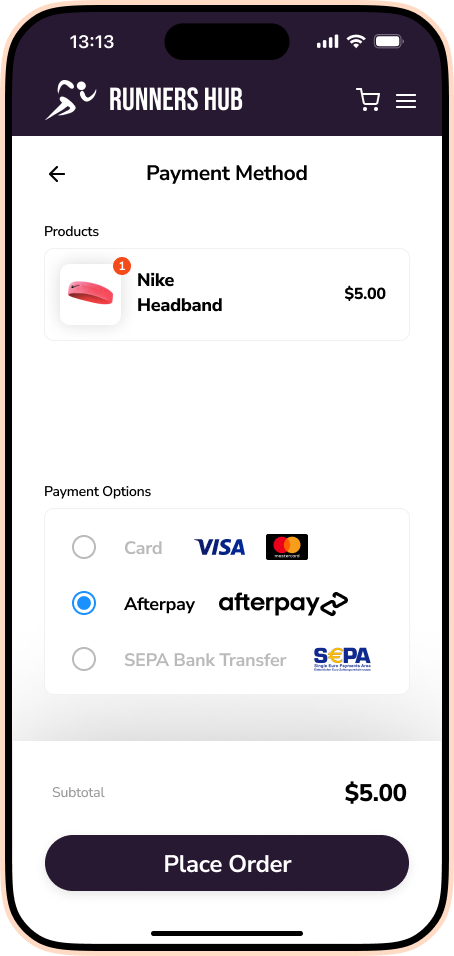

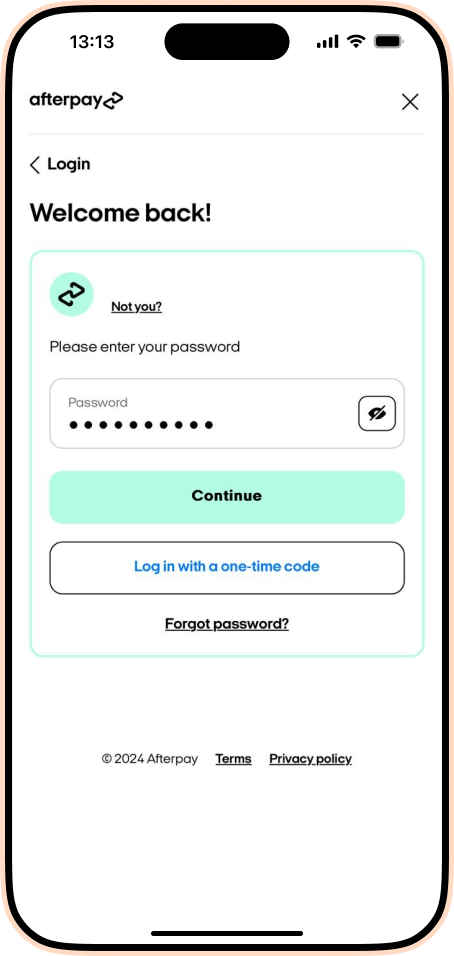

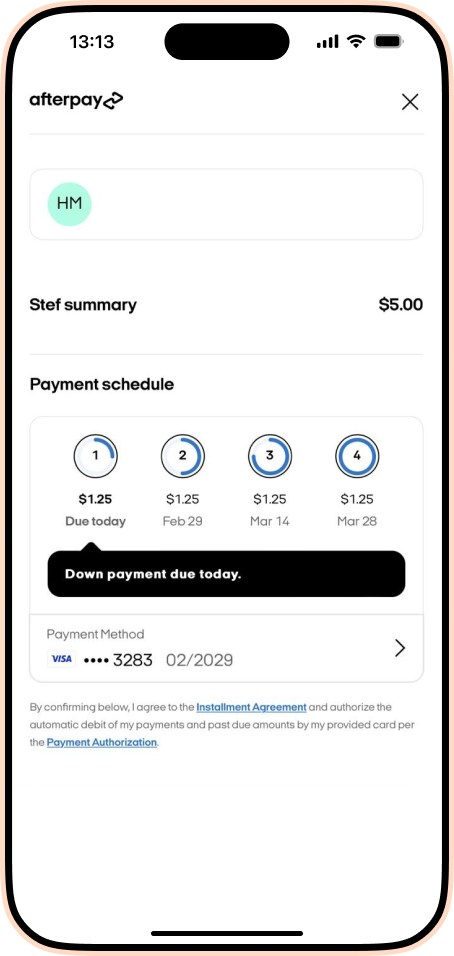

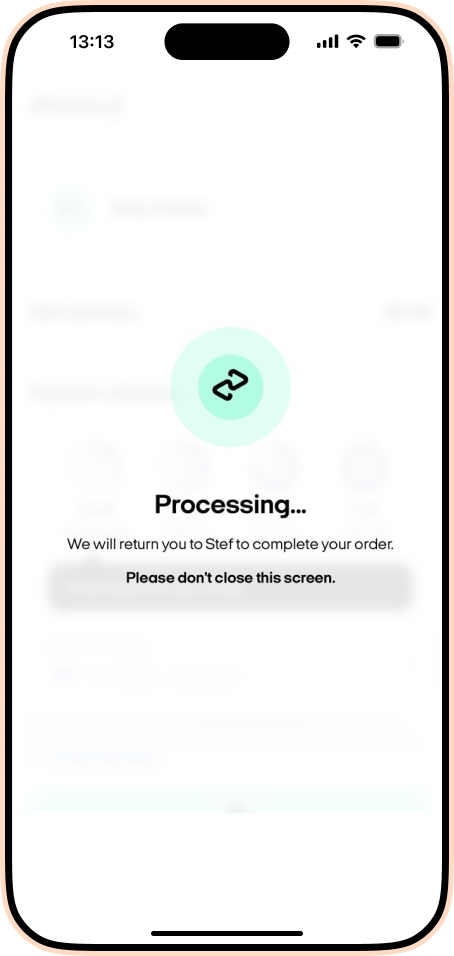

Afterpay / Clearpay

Afterpay is an interest free Buy Now Pay Later product. Consumers can choose to Pay-in-4 interest free instalments or qualified Afterpay consumers will be offered an additional Afterpay repayment option during checkout, allowing them to pay over 6 or 12 monthly instalments. With a global payback rate of 95% early or on time, transparent spending limits and capped late fees, Afterpay aims to unlock growth for merchants and at the same time prevent overspending for the consumer. In the UK, Afterpay operates under the name ClearPay.

Want to integrate Afterpay / Clearpay onto your platform?

Get in touchWhy Afterpay / Clearpay

Merchants who started offering Afterpay saw as much as 2X increase in the numbers of unit items purchased, 58% higher average order value and an 18% decrease in return rates.

Afterpay reports there are more than 8m+ monthly active users in 2023 and nearly 50% of buy now pay later consumer spend stays with Afterpay.

In 2022, Afterpay processed a GMV of $29B across 200,000 participating merchants.