GoPay by Gojek

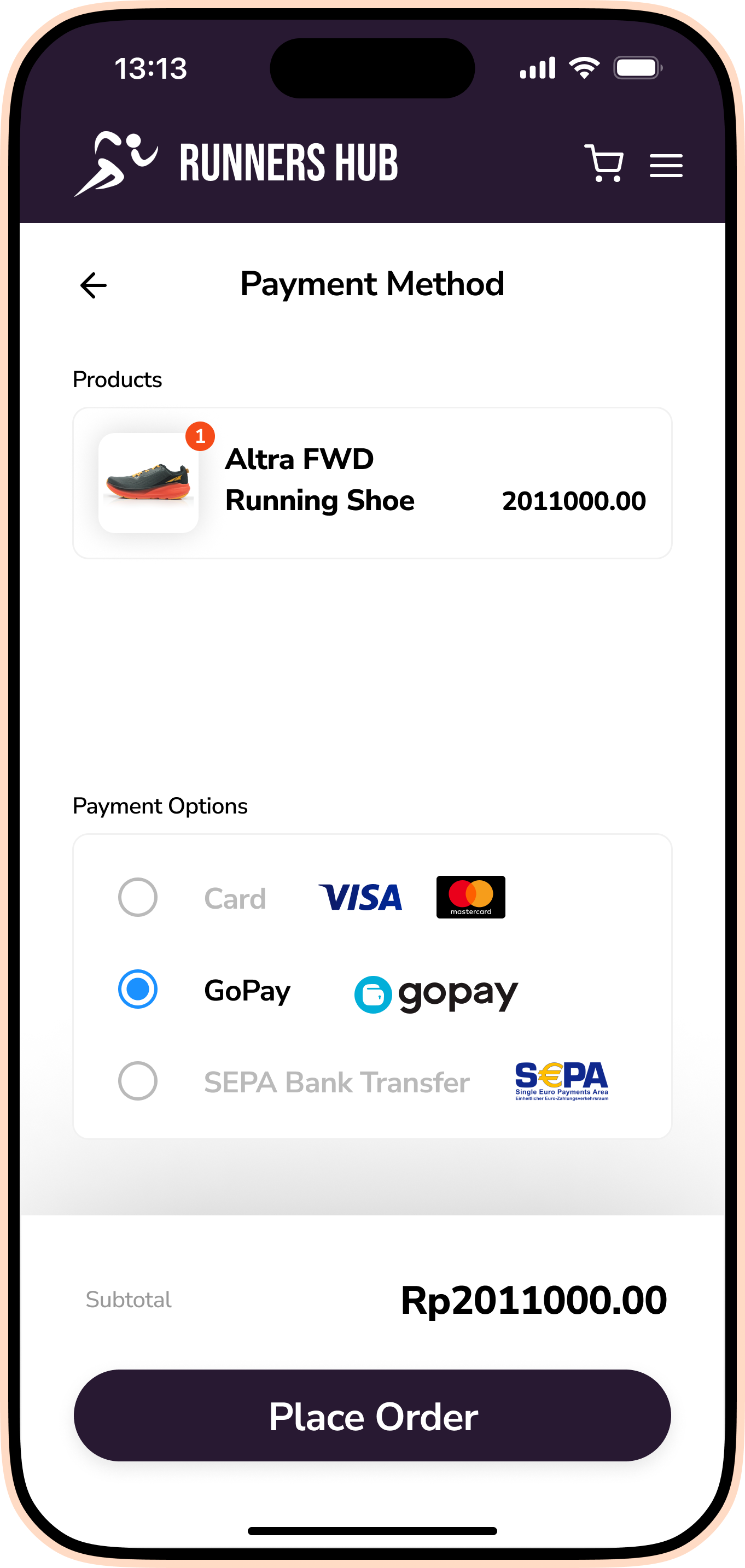

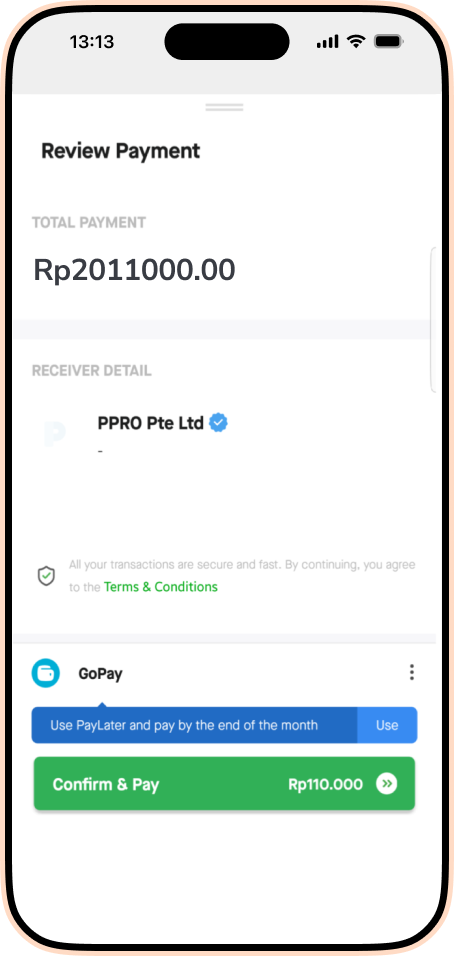

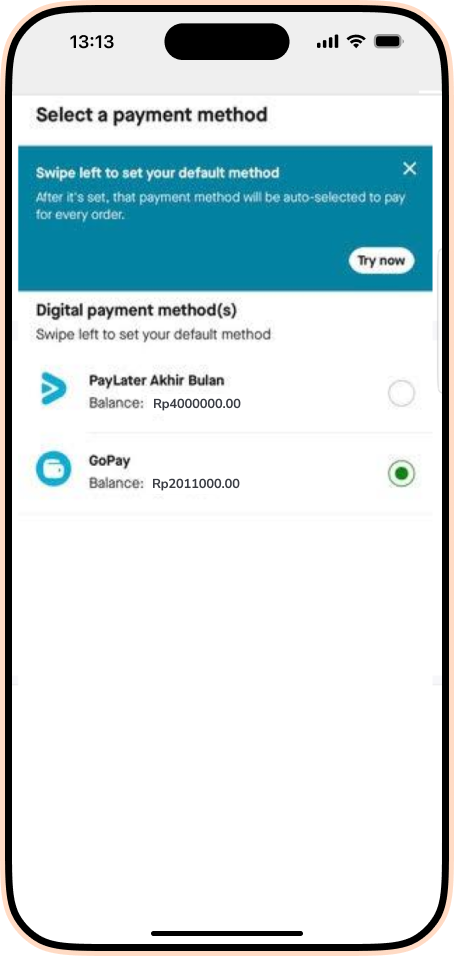

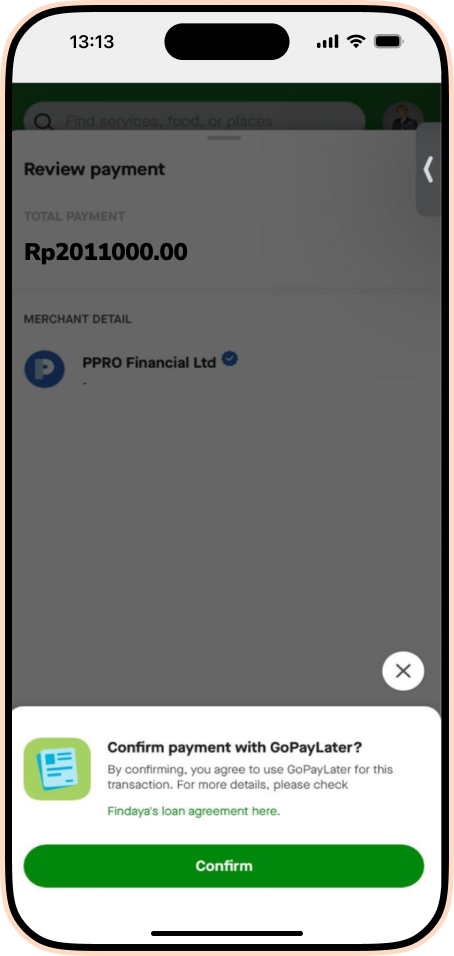

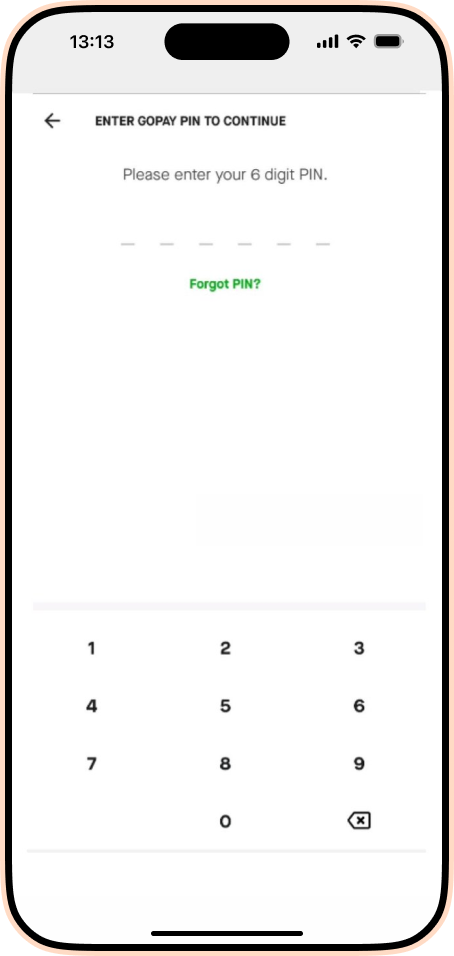

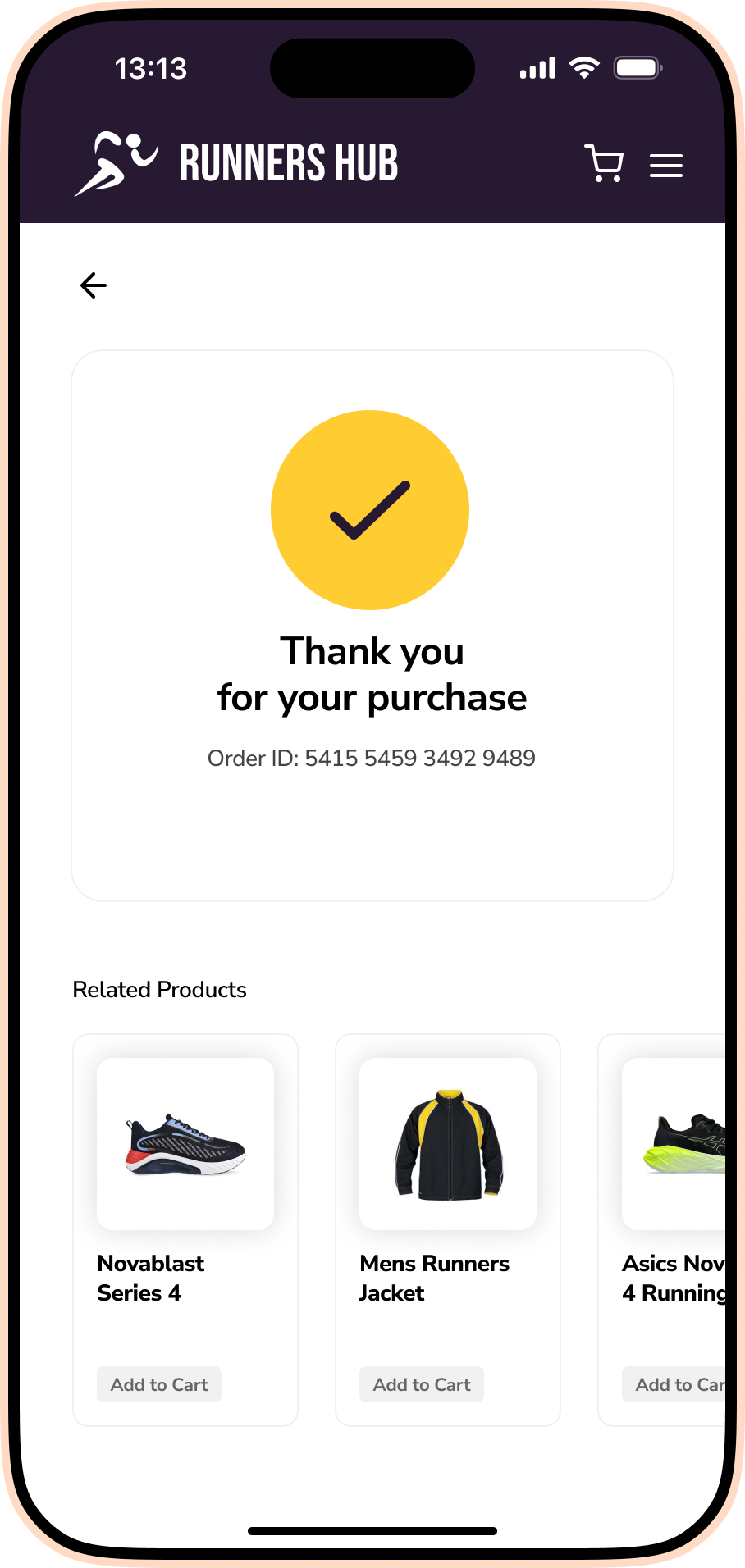

GoPay launched in 2016 as an e-wallet for Gojek, with its real differentiator being exclusive integration into the Gojek super app: meaning the choice of payments for rides, food deliveries and more is either cash or GoPay. With a focus on empowering the unbanked and underbanked, GoPay has quickly become one of the leading payment platforms in Indonesia, seen by millions as safe, secure, inclusive and comprehensive. Suitable for high-volume enterprise merchants. Consumers top up their GoPay wallet with cash directly to Gojek drivers or at ATM machines, and via SMS or online banking. Consumers pay by simply confirming the order and entering their PIN. Furthermore, they have the option to pay immediately or to use the PayLater option to pay at the end of the month.

Want to integrate GoPay by Gojek onto your platform?

Get in touchWhy GoPay by Gojek

GoPay has a 25% market share ( (Kadence)and 58% brand recognition (Ipsos) indicating a widespread trust that can help cross-border entrants win over local consumers.

GoPay reported, in just the first quarter of 2022, consumers made payments worth more than US$500 million. Over the course of the year, gross transaction values increased by 47%.

According to Gojek, GoPay is accepted by 900,000 merchants across channels. By accepting GoPay, 93% of small and medium merchants increase transaction volumes and 55% increase their revenues.